Growth Share Matrix (BCG)

The BCG matrix or Growth Share Matrix bears the name of its inventor: the Boston Consulting Group, it is used in marketing and in strategic analysis to compare the commercial offers, activities or business unit of a company according to the attractiveness of the market and their advantages and competitive. Growth Share Matrix is used to identify growth opportunities and help entrepreneurs make investment decisions based on their positions.

The approach consists of mapping the portfolio of commercial offers (products and/or services) according to these two criteria in order to prioritize the strategic actions to be carried out according to the potential of their individual developments. Managers will thus be able to choose to prioritize investments on certain offers whose potential has been deemed more interesting for the company’s strategy.

The BCG matrix can also be used to define the strategy to adopt when setting up a business. It is then used to map the target market and position competing offers.

WHAT IS THE BENEFIT OF THE BCG MATRIX?

What is the objective of the process?

To ensure its sustainability, a company must have a balanced portfolio of products or activities. It needs driving products that bring profitability and others, in the making, whose objective is to reinforce or replace driving products.

The BCG matrix is used to position the products, activities or commercial offers of a company according to two criteria:

- The dynamism of the market;

- The company’s relative market share.

This makes it possible to study and manage the balance of the business portfolio by choosing the actions to be taken to ensure the development of the company.

Why is it necessary?

When a company evolves in a competitive market, it must constantly adapt to changes in the market and its competitors. This adaptation requires uninterrupted monitoring in order to follow the evolution of the market and adapt its positioning accordingly.

Read also: Basics of Management | Planning, Organizing, Leading and Controlling

HOW TO MAKE A BCG MATRIX?

The BCG matrix is built in 3 steps before it can be analyzed:

Step 1:

Evaluate each activity of the company (or competitors) according to two criteria:

relative market share. It is calculated according to the ratio: market share of the company/average market share of the main competitors.

The growth rate of the market. This is raw data, however, depending on the case and the types of analysis, we will use: the market growth rate, the sales growth rate or the overall progression of the company’s sales.

Step 2:

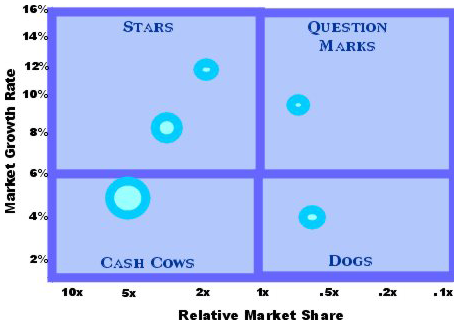

Place the different activities studied on a graph with the growth rates on the ordinate and the relative market share on the abscissa. Once the activities are placed on the matrix, each axis will be split into 2 in the middle. We then obtain 4 identical sectors which will make it possible to locate the activities on the graph as: cash cow, dead weight, dilemma and star.

Step 3:

For a good analysis, other specific criteria must be taken into account such as the volume of activity (actual or expected), the life cycle of the product, the level of profitability, the contribution of the products to the brand, the level of competition… These criteria can be represented graphically in different ways:

The size of the circle can represent the turnover or the level of profitability;

Color can indicate where the product is in its life cycle;

Some acronyms may indicate the level of competition;

BCG Matrix Ian Dunster, English Wikipedia User, CC BY-SA 3.0, via Wikimedia Commons

Once the mapping of the different offers or activities is completed, we can move on to the analysis phase of the BCG matrix.

Remark :

When the acquisition and maintenance of market share does not require significant communication expenditure, the growth rate can be considered to give an indication of liquidity needs and that the relative market share provides information on the liquidity generated by the activity.

HOW TO ANALYZE A BCG MATRIX?

The four parts of the matrix contain activities with specific characteristics.

Star activities

Stars correspond to leading offerings or activities in a growth market. This is an interesting situation which, however, requires continued investment (financial, communication, skills, etc.) to support their growth and their predominance over competitors. They are therefore not always very profitable. If the company’s strategy is effective, the stars will become cash cows once the market matures.

Cash cow activities

Vache à laits products correspond to the company’s offers or activities located in a market with low growth and/or maturity. The company is in a strong position since it has a strong competitive position (relative market share > 1). Cash cow products require little investment to maintain, they are profitable and generate cash that can be used to finance the development of other projects.

Dogs (Dead weight activities)

Deadweights correspond to offers or activities located in a low-growth market. This market may have reached maturity or may have started to decline. The company is in a weak position since it is unable to improve its profitability. In a low-growth market, competition tends to intensify, which considerably lowers the return on investment of communication approaches.

In this situation, it is advisable to divest or cut costs to preserve profitability.

Question marks (Dilemma activities)

Dilemmas correspond to offers or activities located in a growing market without being among the leaders. Not benefiting from a strong competitive position, the company can try to take advantage of market growth to improve its commercial presence, but it needs the financial means to do so.

However, the dilemmas remain risky activities for which it is not known whether they will be able to acquire a sufficient market share to be able to make a profit from the costs incurred. Management must succeed in distinguishing and choosing the most promising and profitable activities. To do this, it can use and combine certain tools such as market research, Pestel analysis or SWOT.

Complete the analysis

We obviously cannot base a strategic approach on the simple use of the BCG matrix.

It is possible to supplement the elements of the BCG matrix with other criteria. In our example below, we have added additional criteria that will help to better understand the situation:

The size of the circles represents the turnover of each product within the portfolio

The color of the outline is used to indicate whether the competition of the product is weak, medium or strong

The color of the circle makes it possible to locate or is the product of its life cycle

THE PRODUCT EVOLUTION CYCLE

The matrix makes it possible to highlight the evolutions of the product on its market:

1 – To have a maximum chance of success, companies generally launch new products in a dynamic and growing market.

2 – Depending on the market share that this product manages to acquire, it becomes a star or vegetates among the “dilemma products”.

3 – As long as the market is growing, the company has an interest in investing to develop or maintain its market share. Thus, when the market reaches its maturity phase, it can benefit from a situational rent and obtain good profitability in a market which, being no longer very dynamic, makes it more difficult for new players to enter and the progress of actors present. Knorr sachet soups, for example, are a cash cow product in a profitable situation: the brand maintains communication to maintain its position in relation to competitors, knowing that the importance of the investment and the low level of margin deter entry. new leading players in this market.

4 – The strategic challenge will be to succeed in relaunching or adapting the product so that it can return to dilemmas and start a new cycle, rather than ending its life cycle with dead weights.

METHODOLOGY AND TIPS FOR CREATING AND ANALYZING YOUR BCG MATRIX

To be relevant, the analysis of the BCG matrix must be associated with complementary elements. Thereby:

The BCG matrix is not always relevant. A dominant position in a market is not always synonymous with significant profitability. When market share is gained through heavy investment in communication, it reduces the profitability of the product. Conversely, a low market share can be profitable for a follower company that copies the innovations of the leaders at a lower cost and thus saves R&D costs.

The BCG matrix does not take into account synergies between portfolios, activities or business unit of the same company. Some unprofitable products can lead to the sale of induced products (the sale of a coffee machine encourages the recurring purchase of the brand’s pods). The BCG matrix shows that this group has no cash cow business unit. On the other hand, the synergy between the business unit is a source of value creation and profitability.

The strong presence of a company in a market (relative market share >1) is not in itself a Key Success Factor, it must be associated with a growing market.

The growth of a market is not always a sufficient indicator. Customer satisfaction, return rate, quality of service… are also elements that contribute to increased sales.

THE ADVANTAGES OF THE BCG MATRIX

The BCG matrix is a simple and easy to understand tool. It provides managers with a relevant basis for reflection to guide their strategic choices. It can be associated with other tools that will complement the elements of reflection it provides.

http://cleverlysmart.com/crafting-a-comprehensive-business-plan-key-elements-and-best-practices/

Sources: PinterPandai, Consultant4Companies

Photo credit: geralt via Pixabay